Invest in Mojo and double the value of your shares within 6 months

Participate in Mojo’s Initial Private Offering with investments ranging from €295 to €118,000 and see your shares double in value in just 6 months.

A+ Rating

Avg rating 4.8 from most of our clients.

Invest, Double, Sell

Step One: Invest Now

Invest in the first round now to secure a special share price and the opportunity to double your investment within 6 months.

Step Two: We double your shares

In the next round (approximately in 6 months), Mojo will issue one additional share to existing shareholders (like you) for every new share issued to new investors.

Step Three: Split & Triple

Before the 3rd round of funding, Mojo will split and triple your shares. Why? Because it's the perfect time (if you choose) to sell your shares and achieve a return on investment (ROI) of up to 100%.

If you want only the important information in brief, then go to this page

MUST KNOW

Key Information

Business banking has become increasingly messy. With the rise of challenger banks, banking apps, cashback schemes, and crypto, the landscape is becoming more fragmented. The real issue isn’t the abundance of choices; it’s the lack of connection between them.

Come to Mojo.

AFTER FUNDING VALUATION

47.000.000 €

FUNDING TARGET

1.475.000 €

SHARE PRICE

5,90 €

EQUITY

12,5%

NET REVENUE AFTER FUNDING

8.000.000 €

SHARE PER VALUATION DISCOUNT

More than 50%

Mojo in five paragraphs

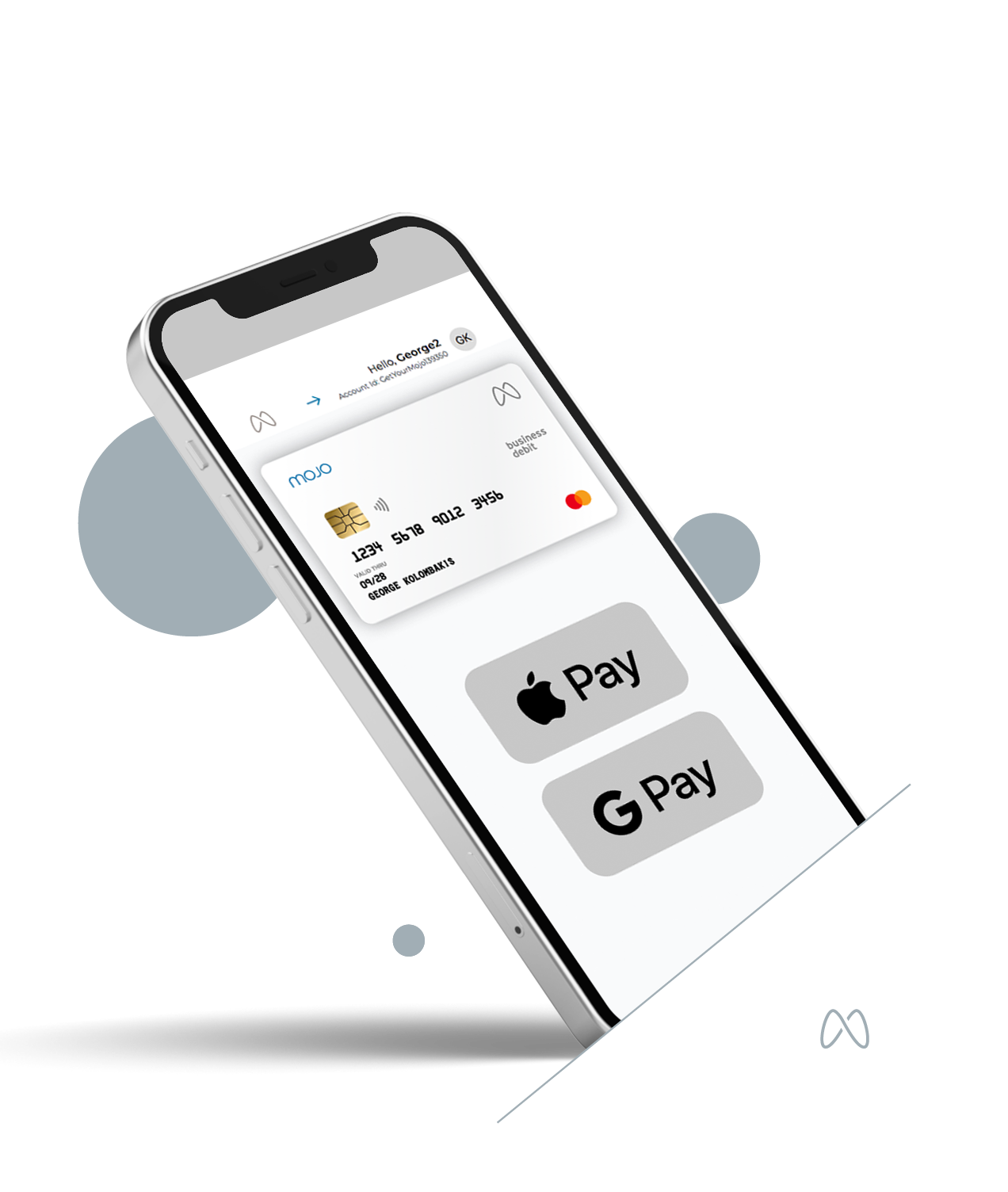

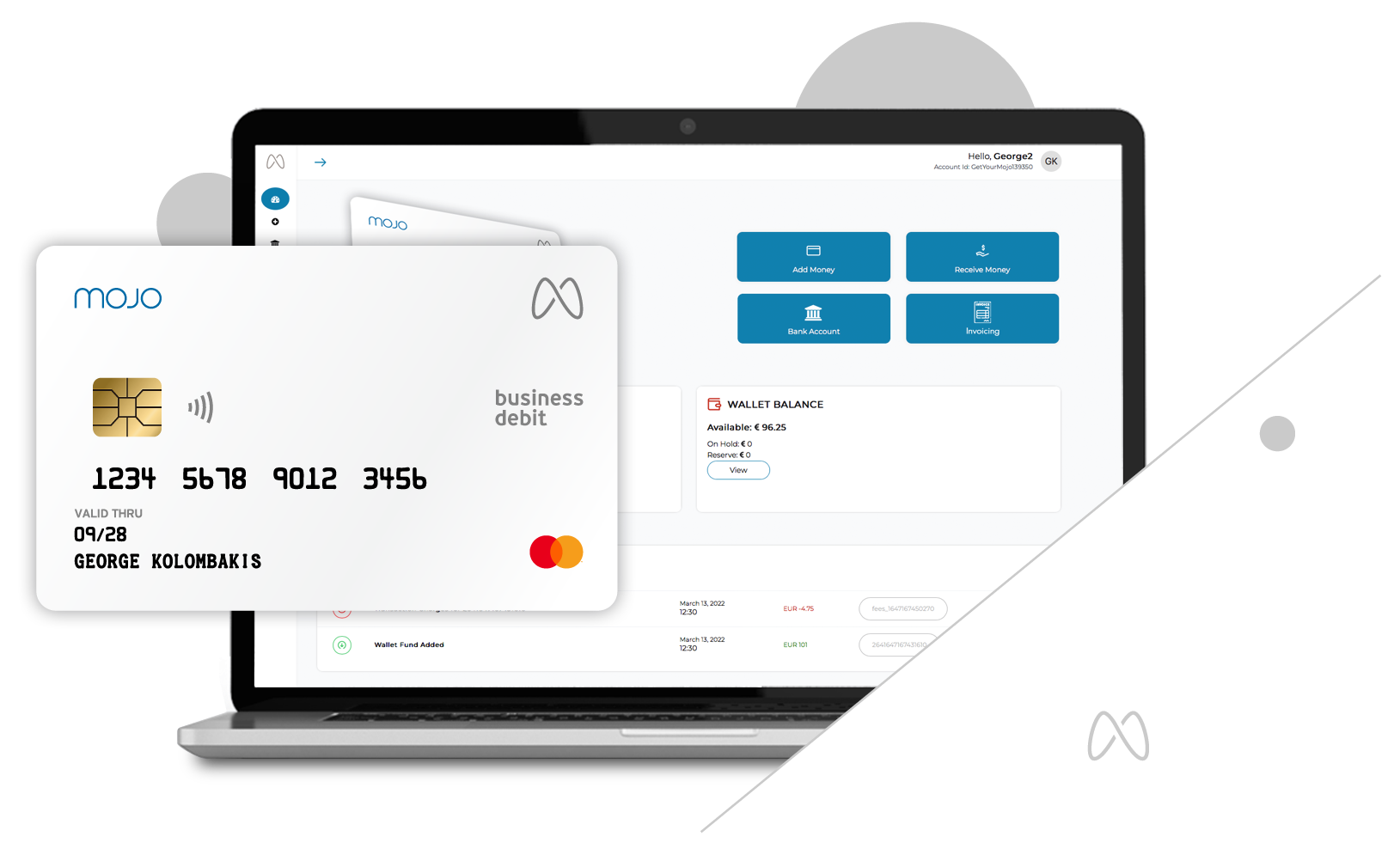

Mojo is on a mission to transform business banking and finance with a unified platform designed to streamline and integrate how businesses manage spending, sending, tracking, and collecting money. With just one card and one app, Mojo aims to bring clarity and organization to financial operations.

Business Bank Accounts

All the transactions in one app. Very low fees & high end security. Multicurrency account & IBAN.

Collect Money

Mojo's collecting money solutions through POS terminals, eCOM, Payment links and Tap 'n' Pay

VCC Payments

Our Award winning Virtual Credit Cards platform for business payments.

Funding & Lending for Businesses

We're a key player in finance, emphasizing our status as a welcoming fintech. Our tailored solutions precisely meet your needs.

Mojo's Business Plan 2025

NET EARNINGS

10.000.000

NEW BUSINESS CLIENTS

10.000

VIRTUAL CREDIT CARDS NETWORKS

5 WITH ACCESS TO 50.000 CLIENTS

CO BRANDED B2B CLIENTS

3

NEW AGENTS & OFFICES

+100

NEW BUSINESS PARTNERS

7

NEW EXCLUSIVE SERVICES

7

NEW GEO PRESENTAGE

MOJO FINTECH NORTH AMERICA

Awards

Tourism Awards 2024: Gold for Digital Payments

Enterprise Greece / Thriving Global 2024: Top Shortlisted US-MAC / Silicon Valley

Best Payment Provider 2024 by The Digital Banker: Top 5 Paynt

Risk warning

Investing in start-ups and early stage businesses involves risks, including illiquidity, lack of dividends, loss of investment and dilution. Mojo is targeted exclusively at investors who are sufficiently sophisticated to understand these risks and make their own investment decisions. You will only be able to invest in Mojo once you are registered and accept Terms & Conditions.

Read Risk Warning

Read Terms of Invest